Trading Foundation – How to Create a Winning Trading Bot Series

Mastering the 3 Core Elements of Trading for Beginners

When starting to learn about trading, you’ll often encounter terms like charts, candlesticks, timeframes, RSI, MA, and MACD. But do you truly understand the foundation behind these tools? Surprisingly, all the indicators and patterns stem from three basic elements: Price, Volume, and Time. Understanding these will help you build a strong trading foundation.

1. Price

Price reflects the value of an asset at a specific moment. It’s essentially what buyers are willing to pay and sellers are willing to accept. For example:

If Bitcoin is priced at $50,000 right now, it means someone just agreed to buy 1 BTC or a fraction of it (e.g., 0.001 BTC) at that price.

Price Movement Example:

- 10 days ago, Bitcoin traded between $30,000 and $35,000. Today, it’s trading at $50,000—a 40% increase overnight. Why? The market decided.

Price represents the consensus of market participants at a given moment. It’s important not to judge whether the price is “too high” or “too low”—instead, accept it as the market reality. This mindset helps you trade objectively, free from fear or bias.

2. Volume

Volume is the quantity of an asset traded within a specific timeframe. It’s a crucial metric for understanding market activity.

Why Volume Matters:

- Liquidity: High volume means high liquidity, making it easier for trading bots and manual traders to execute orders efficiently.

- Market Health: Low-volume markets can be more volatile and prone to manipulation.

Practical Example:

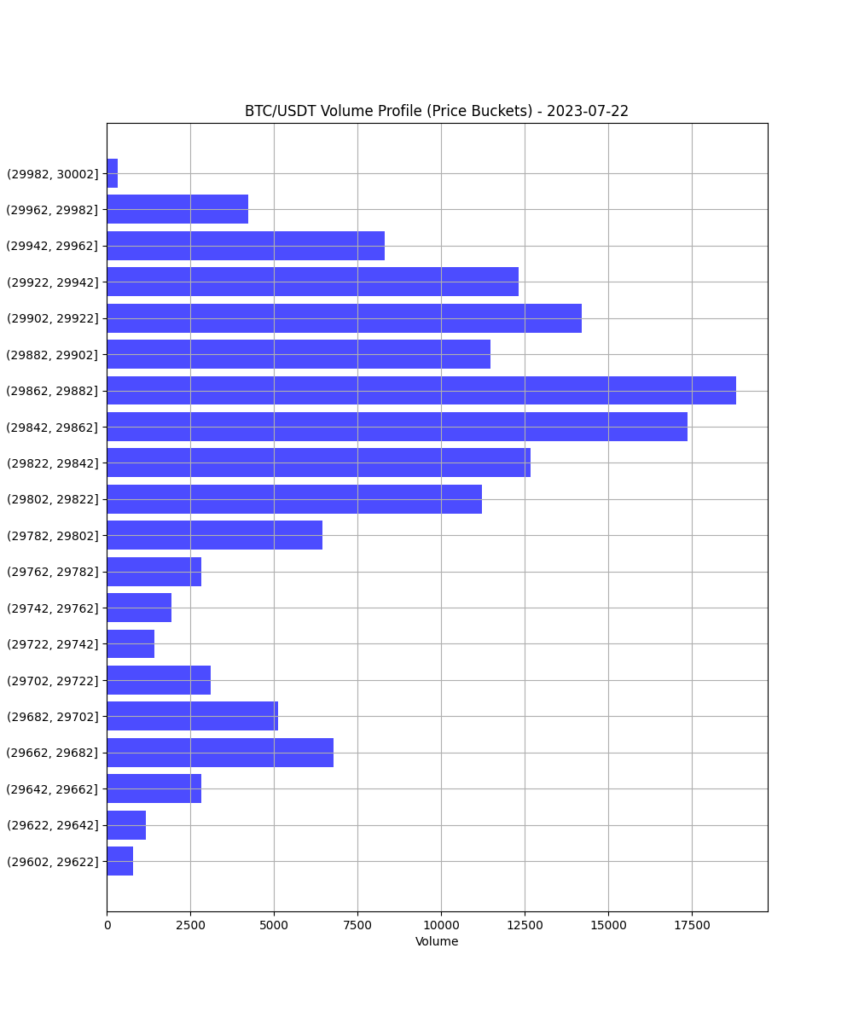

On July 22, 2023, Bitcoin was trading between $29,600 and $30,000. A volume profile analysis revealed that 17,500 BTC were traded in the $29,862 to $29,882 range. This “preferred trading zone” indicates significant supply and demand levels, which can act as support or resistance in smaller timeframes.

If you want to explore this data, you can download it here.

3. Time

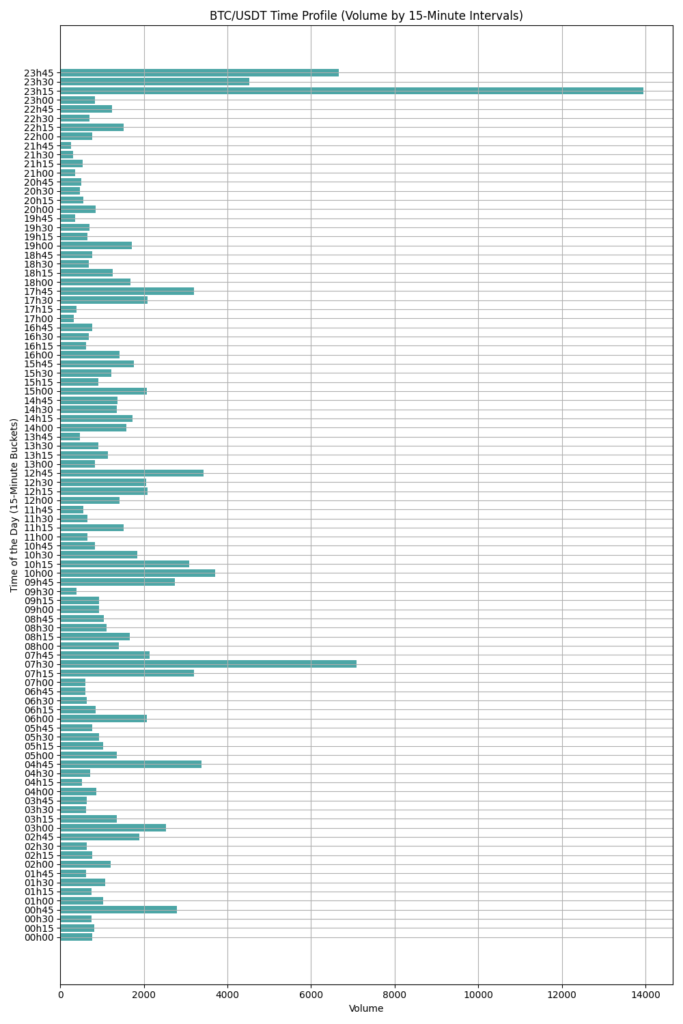

Time is often overlooked compared to Price and Volume, but it plays a significant role in trading. Most technical indicators and algorithms focus primarily on Price and Volume, but understanding the timing of market activity can enhance your strategies.

Time-Based Considerations:

- End-of-Day Trading: Avoid trading near the end of the day (e.g., 23:45 to 00:00), as this period often sees heightened volatility due to buyer-seller competition. For example, you might notice a bullish hammer candlestick forming in the final 15 minutes of trading.

- BTC.D Index Timing: If you trade BTC/USDT, monitor the BTC.D index. When the BTC.D index rises, it signals a significant price movement in Bitcoin, creating potential opportunities for profit.

What’s Next?

By mastering Price, Volume, and Time, you’re setting a strong foundation for your trading journey. In the next part of this series, we’ll dive deeper into understanding candlestick patterns and technical indicators, exploring how they connect back to these core elements.

Stay tuned as we build on these basics to help you create effective trading strategies and confidently approach algorithmic trading!