Master Algorithmic Trading: A Beginner’s Guide to Profitable Crypto Strategies and Risk Management

Welcome to this beginner-friendly guide on making money with algorithmic trading in the cryptocurrency market.

Why does the algorithmic trading ?

Algorithmic trading, also known as algo trading, refers to using computer programs to execute trades based on pre-set instructions. These systems can operate 24/7, allowing traders to capture opportunities in dynamic markets like crypto.

If you’re skilled at manual trading and achieving consistent profits, you might not need an algorithmic approach. However, for those seeking systematic and consistent strategies, algorithmic trading is the perfect tool.

For example, an algorithm could simply open a long position on BTC/USDT every Monday and close it by Sunday if the previous week’s candle is green.

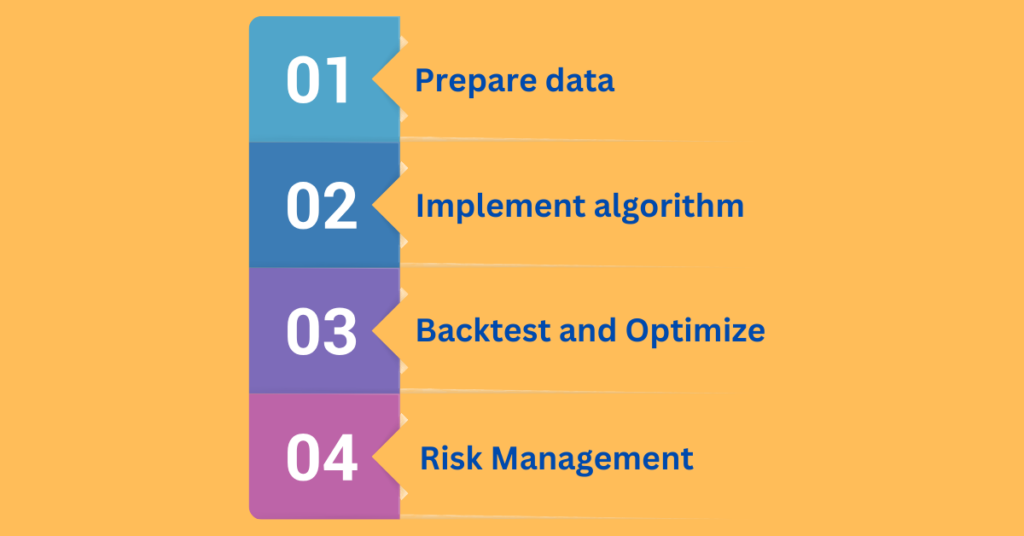

A Step-by-step process that create an algorithm that work

Many wonder if algorithmic trading truly delivers profits and how to create a successful algorithm. Based on my experience, about 5% of trading bots I’ve created consistently generate profits, while the remaining 95% fail due to market evolution.

This guide breaks down the process into four actionable steps to create a successful trading algorithm.

Prepare data

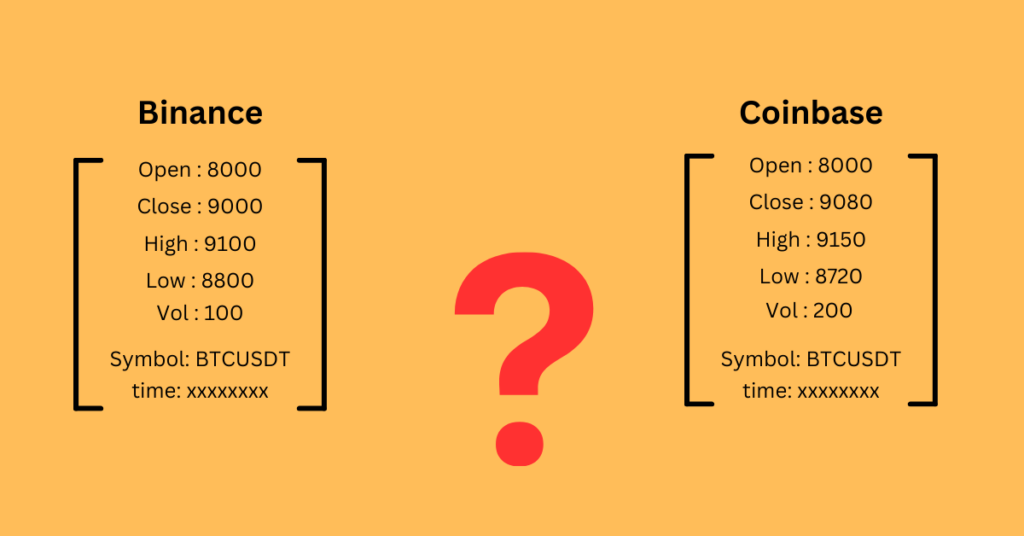

Accurate data is crucial for backtesting algorithms. Key points to consider:

– Prices and volumes for the same asset (e.g., BTC/USDT) may differ across exchanges.

– Not all exchanges provide sufficient historical data.

Pro Tip: Use historical data from the same exchange where you plan to deploy your bot for consistency.

Implement algorithm

This step involves translating your trading ideas into a computer-executable program.

The possibilities are endless, from simple strategies like using RSI(14) or MA(100) and MA(200) crossovers to more complex indicator combinations.

Tip: Avoid the temptation of creating a “perfect” algorithm—it’s akin to chasing a non-existent holy grail in trading.

Check out this example for writing your first bot: Guide to Building Trading Bots.

Back test and optimize

Backtesting evaluates how well your algorithm performs across various market conditions, such as uptrends, downtrends, or sideways movements. Key considerations include:

– Does it work consistently in different years and market trends?

– Are default indicator values (e.g., RSI(14), EMA(34)) optimal, or can tweaking them improve performance?

Backtesting provides a complete picture of your algorithm’s strengths, weaknesses, and ideal configurations..

Risk management

Even if your algorithm shows promise, implementing risk management rules is vital. Define conditions under which you stop trading and rework the algorithm. For instance:

– Maximum consecutive losses: 8

– Maximum drawdown: 40%

If these thresholds are exceeded in real trading, it’s time to pause and reassess. Remember, accepting losses is challenging, but essential for long-term success.

Conclusion

Algorithmic trading is an excellent way to bring discipline and consistency to your trading approach.

In this guide, you’ve learned the basics of algo trading, explored a proven framework, and discovered tips to create profitable bots. Start your journey today and take advantage of the opportunities the crypto market has to offer.